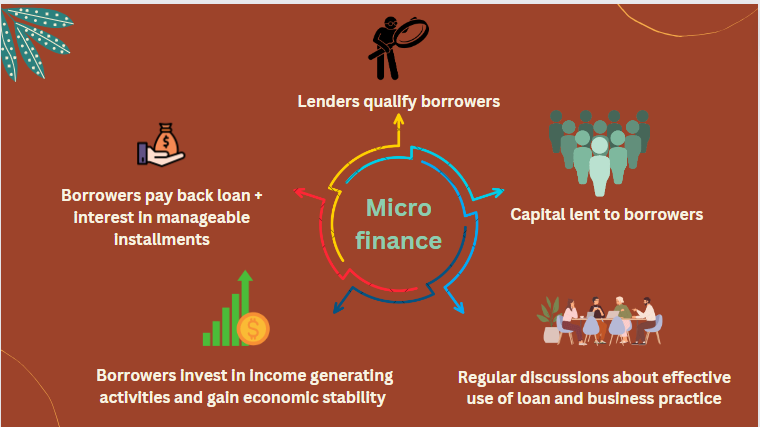

Microfinance, at its core, is a powerful tool for alleviating poverty by providing financial services to those traditionally excluded from the formal banking sector. This includes individuals and small businesses, often in developing economies, who lack access to conventional banking facilities. By extending microloans to these underserved populations, microfinance empowers individuals to generate income, build assets, and enhance their overall economic well-being. The significance of microfinance extends beyond its economic implications, delving into the realm of social impact. As a catalyst for entrepreneurship and self-sustainability, microfinance contributes to community development and the creation of a more inclusive financial ecosystem.

My project is self-learning module on microfinance for impact investing is meticulously designed to cater to seasoned investors, aiming to enlighten them about the intersection of financial growth and social impact. This project recognizes the intrinsic link between financial decisions and societal progress, making a compelling case for seasoned investors to explore the realm of impact investing within the microfinance landscape. The ensuing self-learning module seeks to illuminate this intersection, demonstrating to investors that their financial decisions can transcend wealth accumulation to become powerful instruments for positive change.

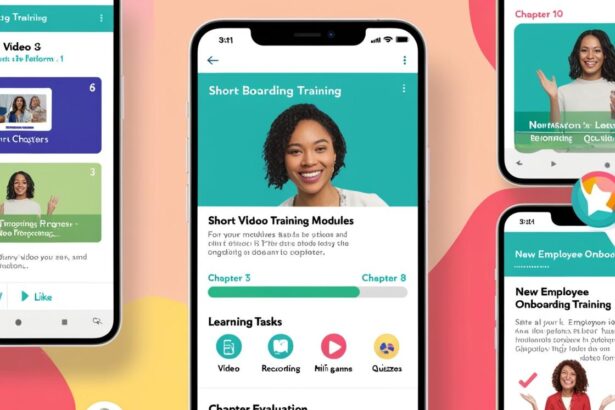

Rooted in the principles of constructivism, the project recognizes that individuals construct their own understanding of a subject by actively engaging with the content. To facilitate this, the module employs a dynamic learning environment that encourages participants to explore and build knowledge collaboratively. The incorporation of peer learning as a central aspect of the design promotes an interactive and participatory experience, allowing investors to share insights, discuss real-world experiences, and collectively deepen their understanding of the potential societal benefits that can be achieved through strategic financial decisions.

This innovative learning initiative not only provides valuable knowledge on microfinance and impact investing but also serves as a practical demonstration of effective learning design. By prioritizing constructivism and peer learning, the project acknowledges the importance of active engagement and collaboration in the learning process. It underscores the idea that individuals, even seasoned investors, are more likely to internalize and apply knowledge when they actively participate in constructing it themselves. As a result, the module stands as a testament to the efficacy of designing learning experiences that go beyond traditional didactic methods, fostering a more interactive and engaging approach to education in the realm of impactful finance.